By FX Empire Analyst - Christopher Lewis:

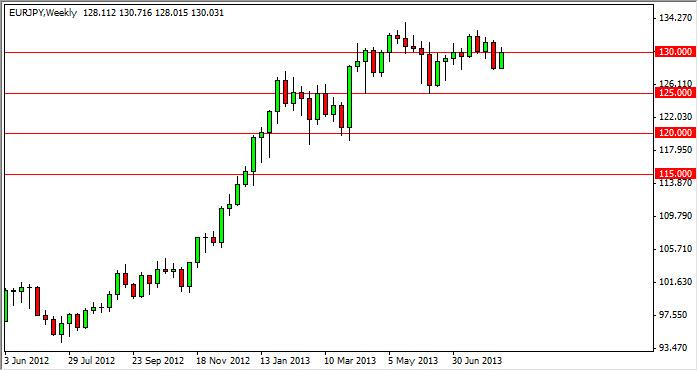

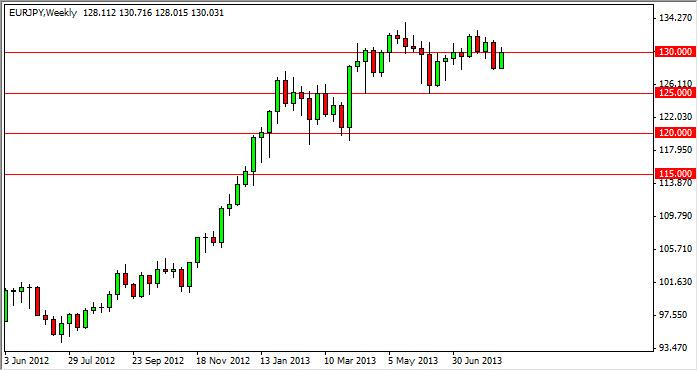

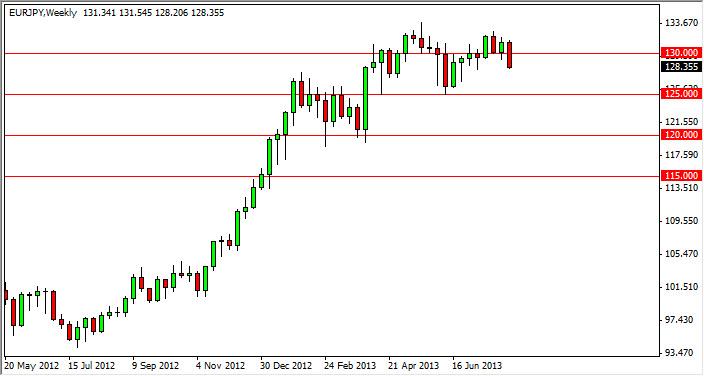

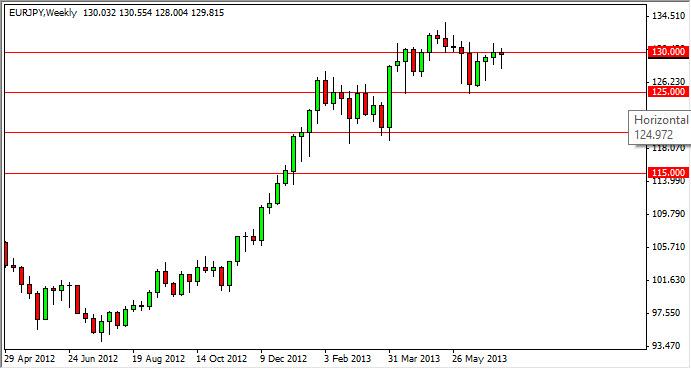

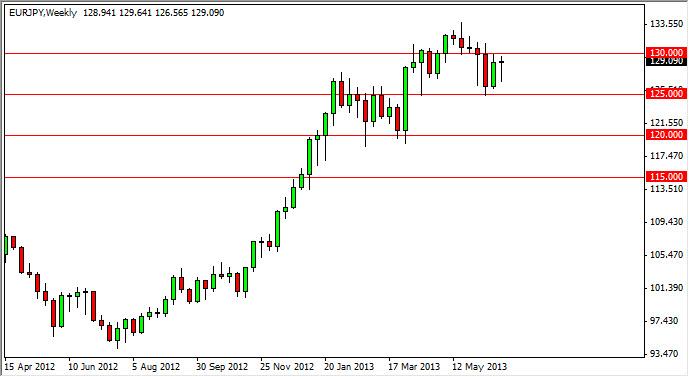

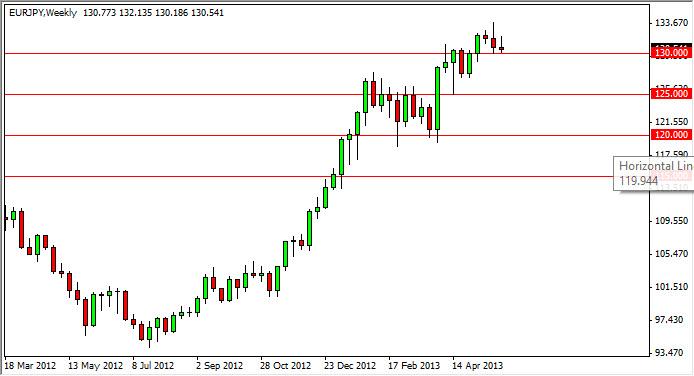

The EUR/JPY pair tried to rally during the week, but as you can see gave back most of the gains. With that being said, this market formed a shooting star that sits right on top of the 130 level, an area that has been supportive. Because of this, we feel that the market may try to pullback, but there is so much support below that selling this market is dangerous to say the least. In fact, if we fall at this point in time, we are willing to buy supportive candles as they appear.

As for the Monday 9th daily forecast:

The EUR/JPY pair fell hard during the session on Friday, but slammed into the large support level yet again in order to find the whole. The 130 level has been massive and its implications, and as a result buyers stepped in and push the market back up. On short term charts, we are more than willing to buy this market as we think it will continue to consolidate between 130 and the 132.50 levels over the next several sessions. However, we are more bullish than bearish, and would be more comfortable buying then selling at this point.

By FX Empire Analyst - Christopher Lewis:

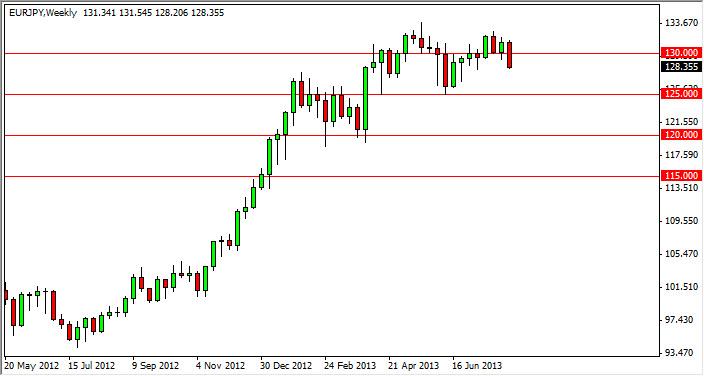

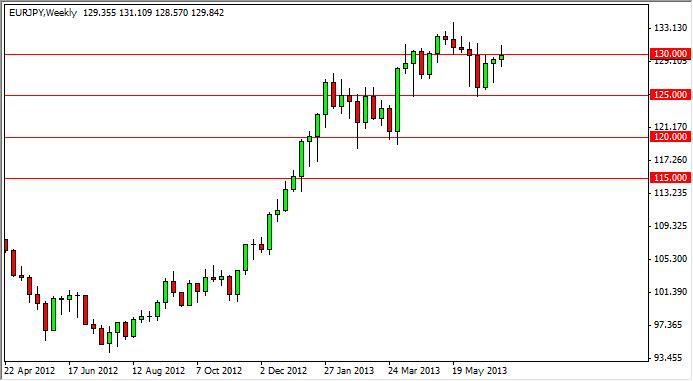

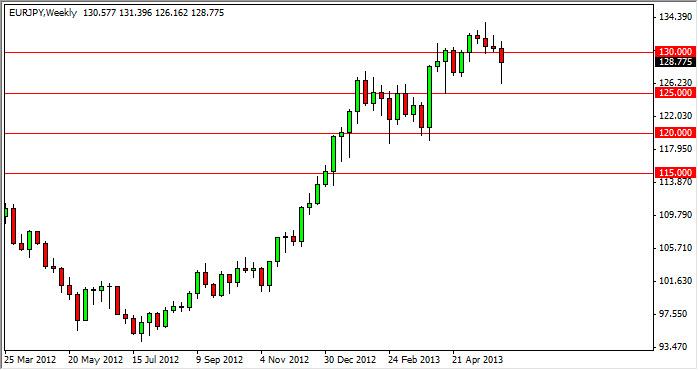

The EUR/JPY pair rose during the week, slamming into the 130 handle again. We still believe that this pair is in an uptrend, and it is simply taking a bit of a break for the summer. That being the case, we are more than willing to buy on a break above the 130 level based upon a daily close. However, real traction in this pair will be picked up until we get above the 133 handle, something that doesn’t look likely in the next couple of weeks considering the fact that we are in the dead of summer.

The EUR/JPY pair rose during the week, slamming into the 130 handle again. We still believe that this pair is in an uptrend, and it is simply taking a bit of a break for the summer. That being the case, we are more than willing to buy on a break above the 130 level based upon a daily close. However, real traction in this pair will be picked up until we get above the 133 handle, something that doesn’t look likely in the next couple of weeks considering the fact that we are in the dead of summer.

As for the Monday 19th daily forecast:

The EUR/JPY rose during the session on Friday, but struggled at the 130 handle as you can see. This is a level that has been hotly contested recently, and as a result it does not surprise us to see the market gravitate towards it, but not really be able to break free of it. On a move above 131 though, we think this market will head the 133. On pullbacks we find this market interesting, and would buy supportive candles all the way down to the 128 handle in the immediate future. Below there, we feel that the 125 level is the floor in the market as well.

By FX Empire Analyst - Christopher Lewis:

As for the Monday 12th daily forecast:

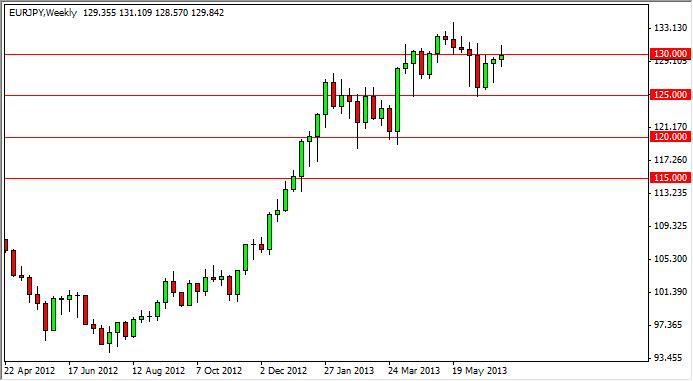

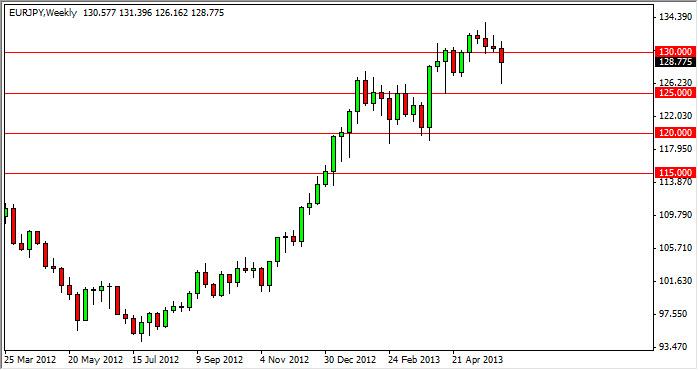

The EUR/JPY pair fell during the session on Friday, attempting the bottom of the hammer from the Thursday session. We are still above the 128 handle though, and there is a significant amount of support in this general vicinity. Beyond that, there is a ton of support down at 125, so we think that any downside move will be somewhat limited. Are looking for a supportive candle in order to start buying, but we simply do not have it at this point in time. We actually get more interested in going long the lower that we go in this pair.

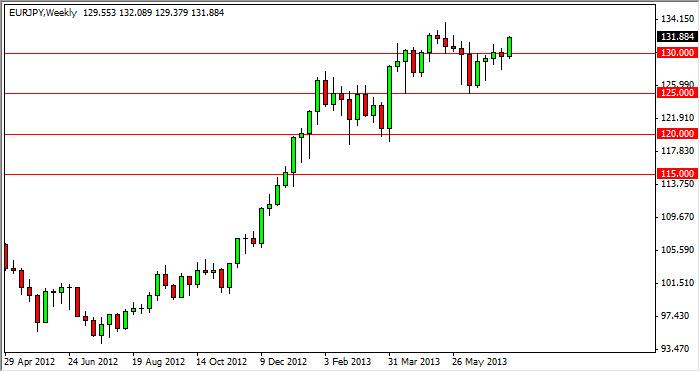

The EUR/JPY pair fell during the balance of the week as we crashed through the 130 level, an area that had been rather supportive. However, we see quite a bit of support all the way down to the 125 handle, so we’re not very impressed. In fact, we feel that we are simply going to flounder around between 125 and 133 for the remainder of the summer. Right now, and looks like this market is heading lower, but we feel much more comfortable going long as his pair has been so bullish lately.

As for the Monday 12th daily forecast:

The EUR/JPY pair fell during the session on Friday, attempting the bottom of the hammer from the Thursday session. We are still above the 128 handle though, and there is a significant amount of support in this general vicinity. Beyond that, there is a ton of support down at 125, so we think that any downside move will be somewhat limited. Are looking for a supportive candle in order to start buying, but we simply do not have it at this point in time. We actually get more interested in going long the lower that we go in this pair.

By FX Empire Analyst - Christopher Lewis:

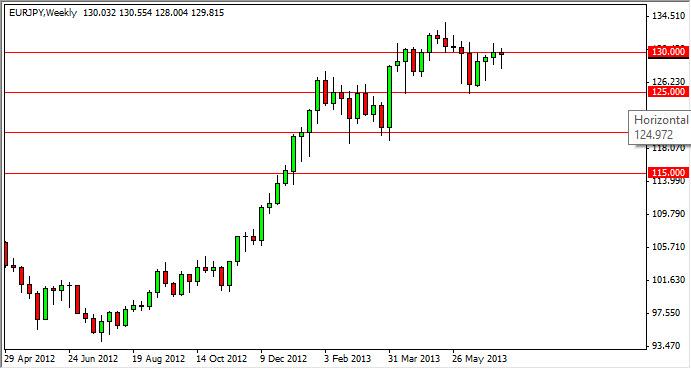

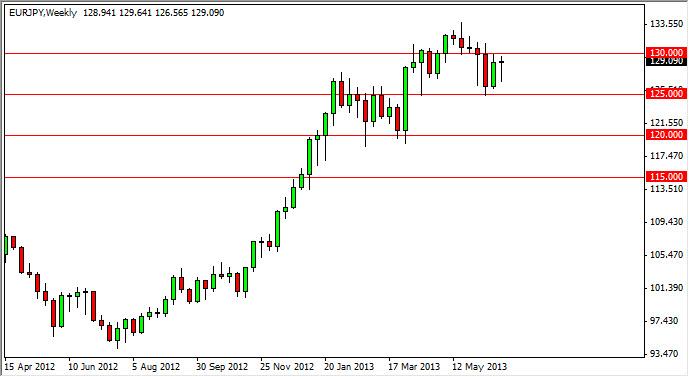

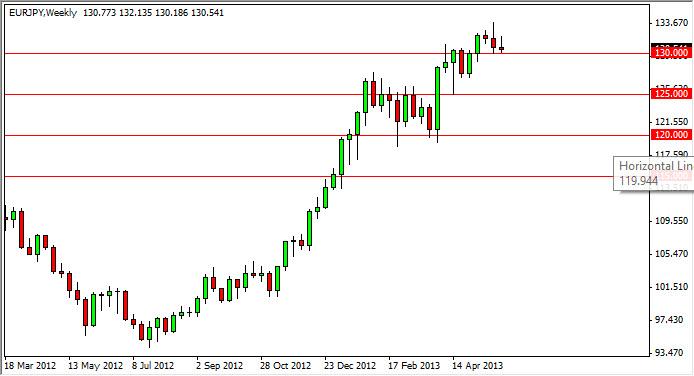

The EUR/JPY pair fell over the course of the week, bouncing off of the 130 level in the end. We expect 130 to be supportive, so a supportive candle were to form in this general vicinity, we would be more than happy to start buying. However, the range is so tight at the moment that we feel this is more or less a short-term market. Of course, we see plenty of upside bias and therefore aren’t selling regardless. Below here, expect quite a bit of support at 128 and 125, with 125 being almost impenetrable.

As for the Monday 29th daily forecast:

The EUR/JPY pair had a very bearish day on Friday, slamming into the 130 handle. We lost 200 pips during the session, what we found interesting is the fact that the 130 level stop this fall dead in its tracks. That doesn’t happen very often, and will normally when it does it shows just how strong a supportive level is. With that being the case, this market looks like it’s ready to find a bounce from this level, and perhaps go quite a bit higher. We’re looking for supportive candles in this general vicinity, and will not hesitate to buy them as they appear.

The EUR/JPY pair fell over the course of the week, bouncing off of the 130 level in the end. We expect 130 to be supportive, so a supportive candle were to form in this general vicinity, we would be more than happy to start buying. However, the range is so tight at the moment that we feel this is more or less a short-term market. Of course, we see plenty of upside bias and therefore aren’t selling regardless. Below here, expect quite a bit of support at 128 and 125, with 125 being almost impenetrable.

As for the Monday 29th daily forecast:

The EUR/JPY pair had a very bearish day on Friday, slamming into the 130 handle. We lost 200 pips during the session, what we found interesting is the fact that the 130 level stop this fall dead in its tracks. That doesn’t happen very often, and will normally when it does it shows just how strong a supportive level is. With that being the case, this market looks like it’s ready to find a bounce from this level, and perhaps go quite a bit higher. We’re looking for supportive candles in this general vicinity, and will not hesitate to buy them as they appear.

This candle does look rather bearish, but the fact that the area could stop

it is cleanly as it did really has us wondering whether or not this wasn’t

simple profit taking at the end of the week that was exacerbating the downdraft.

Because of this, we feel that this market will get picked up somewhere in the

general vicinity, and because of that we are more than willing to start buying

the Euro, and start selling the Yen. Going forward, we fully expect this market

to hit the 133 level again, not to mention the 135 level and beyond.

As far as selling is concerned, it’s almost an impossibility at this point in

time. This is simply because the 130 level has several hammers just underneath

it, which of course is almost always a sign of significant support. Below there,

one 28 level looks to be supportive as well, as it is where the bottom of those

hammers are sitting. With that in mind, we are buying this pair and if you are a

bit aggressive, and you could even start buying right now.

However, the more conservative trader will want to see some type of

supportive candle formed before they go ahead and start committing their trading

capital. Either way is fine, as we think the market has certainly settled on the

direction it once the go over the longer term. We fully expect see 135 hit over

the next couple of months, and are plain this pair as such.

By FX Empire Analyst - Christopher Lewis:

The EUR/JPY pair rose during the previous week, breaking the top of the hammer from the week before. This suggests to us the market is about to go higher, and probably aim for 133 in the short term. We ultimately believe that this is a nice buy signal, and are perfectly comfortable buying it right here as far as selling is concerned, we will not do so because of the Bank of Japan, and look at any pullback as a potential buying opportunity as this market seems to have a long way to go still.

As for the Monday 22nd daily forecast:

The EUR/JPY pair fell during the session on Friday, but as you can see bounced from the 131 handle. This hammer does suggest that we are going higher, and quite frankly looking at the weekly charts it’s hard to argue that point. With that being said, we expect a break of the top of this hammer to signal that we are going higher, and possibly to the 135 handle before it’s all said and done. Pullbacks should be thought of as buying opportunities, and we think that the 130 handle should offer significant support as well.

By FX Empire Analyst - Christopher Lewis:

As for the Monday 15th daily forecast:

The EUR/JPY pair had a slightly positive session on Friday, but as you can see the market still remains below the 130 level. This is an area that’s been a bit of a magnet lately, in this market does look like it’s trying to form a supportive based in this general vicinity. However, there’s nothing in this chart that tells us that we need to necessarily go along at this point. On the other hand, the Bank of Japan is certainly going to work against the value of the yen anyway, so selling is an even a thought at this point in time.

The EUR/JPY pair fell during the balance of the week, but as you can see the market bounced enough to form a hammer. It seems like this market is simply attracted to the 130 handle, so it doesn’t surprise us to see that the market is closed just below it. That being the case, we think that it’s only a matter of time before this market breaks out to the upside, and a move above the highs from this past week would be a valid buy signal after all. Because of this, we fully expect see this market grind higher, and feel that it’s only a matter of time before we reach for the 135 level.

As for the Monday 15th daily forecast:

The EUR/JPY pair had a slightly positive session on Friday, but as you can see the market still remains below the 130 level. This is an area that’s been a bit of a magnet lately, in this market does look like it’s trying to form a supportive based in this general vicinity. However, there’s nothing in this chart that tells us that we need to necessarily go along at this point. On the other hand, the Bank of Japan is certainly going to work against the value of the yen anyway, so selling is an even a thought at this point in time.

By FX Empire Analyst - Christopher Lewis:

As for the Monday 8th daily forecast:

The EUR/JPY pair went back and forth over the course of the last week, eventually closing just below the 130 handle. This candle is relatively neutral though, and as a result it suggests that the support that we have seen over the last couple of weeks should continue to keep this market going higher. Granted, the Euro itself is looking relatively weak, but the Yen continues get absolutely pummeled by almost everybody in the Forex markets now. That being the case, we think that this market will eventually grind its way up to the 133.50 level, and possibly quite higher.

As for the Monday 8th daily forecast:

The EUR/JPY pair fell initially during the session on Friday, but bounced off of the 128.50 level in order to form a hammer. Looking at this hammer, it sits just below the 130 level, and as a result it appears that the market is trying to breakout to the upside, so a move and daily close above the 130 level has buying again. In the meantime though, we think that this market will simply grind sideways, but it is still a market that we simply cannot sell though, simply because of the Bank of Japan and its work to devalue the Yen.

By FX Empire Analyst - Christopher Lewis:

As for the Monday 1st daily forecast:

The EUR/JPY pair initially fell during the course of the week, but as you can see we bounced significantly in order to form a hammer. The hammer is just underneath the 130 handle, which if we can break above that, we think that this is a nice buy signal. There is a bit of resistance above, but we think eventually will be taken out, and as a result we think the longer-term trade is deftly to the upside in this market. Obviously with the Bank of Japan working against the value the Yen, we have no interest in selling this market.

As for the Monday 1st daily forecast:

The EUR/JPY pair rallied during the session on Friday, but found the 130 level still being far too resistant. If we can get above that level, this market really should continue much higher. However, it appears that the market is not quite ready to do so, as we may have a little bit of grinding to do from here.

However, on the longer-term charts it must be noted that the weekly candle is a hammer, even though it is sitting just below the 130 resistance level. This signifies to us that this market may continue to go higher fairly soon, but it may be more of a grind it vanished straight shot higher. If we can get above the 130 handle, we think that this market is a screaming buy, even though it will take a bit of persistence and fortitude in order to hang onto the trade in order to make it profitable.

As far as selling is concerned, we really aren’t that interested even though it appears that we could pull back slightly from here. It’s just far too risky of a move, as it is much easier to simply follow the larger time frames and notice that there are larger forces pushing the market around. Those forces should not be fought against, and as a result we think that this market is essentially a “one-way” trade.

We do see a lot of noise between 130 and 132, so of course if you do find yourself in a position where you are long of this market above that level, you have to understand that the move will take quite a bit of momentum to continue higher, and therefore it could be a rough ride. Alternately though, it seems like this market is destined to go much higher, especially look at the value of the Yen against the Dollar, and the fact of that market looks like it’s ready to continue higher as well. After all, these two markets do follow each other over the longer term as typically is all about the Yen, and not so much about the Dollar or the Euro.

By FX Empire Analyst - Christopher Lewis:

As for the Monday 24th daily forecast:

The EUR/JPY pair attempted to break above the 130 handle again over the last week, but as you can see failed. The matter fact, on the daily chart we have two shooting stars in a row and this of course shows more weakness in them the weekly chart by itself shows. That being the case, we are simply going to wait and hope that this market pulled back to the 125 handle yen, which is an excellent place to start buying. If we get that move, we won’t hesitate on signs of support to start getting long.

As for the Monday 24th daily forecast:

Looking at the EUR/JPY pair, you can see that we have formed two shooting stars in a row now. This was preceded by a hammer, and therefore suggests to us that this market is going to grind sideways. It must be said though, to form two shooting stars in a row does look rather bearish. We think that we’ve got a consolidation area between the 130 handle on the top, and the 127 handle on the bottom. Because of this, we think that this market is a short-term trading environment, and therefore we want to sell towards the top of that range, and by towards the bottom.

By FX Empire Analyst - Christopher Lewis:

As for the Monday 17th daily forecast:

The EUR/JPY pair fell hard after initially trying to rally during the week, in order to slam into the 125 handle. The 125 handle of course is very important, as it was significant resistance back in February and March, and now has been retested several times. All of the yen related pairs have been absolutely erratic, and quite frankly dangerous lately. This of course includes this pair, and as a result a lot of accounts probably got smoked this past week.

However, if there was ever an obvious place for support, the one 25 handle in this market is definitely it. The closing of the week towards the low of the range of course is a bit disconcerting, but quite frankly if we can get some type of supportive candle right around the 125 handle, we wouldn’t hesitate to start buying. It’s difficult to imagine that it will be based off of the weekly chart, so you may have to look towards the shorter-term charts such as the daily, or possibly even the four-hour chart in order to find that signal. Nonetheless, you can still use those shorter timeframe charts in order to find entry points on the longer-term trend.

If we managed to break down below the 125 handle, I would anticipate that the 120 handle would be almost impossible to overcome by the sellers. That is because there is so much noise between 125 and 120, they would take something extraordinarily bearish to happen in order for that was to occur. In fact, under the 120 handle the Bank of Japan would more than likely make its intentions known again by intervening.

Going forward, we fully expect to see this pair return to its bullish ways, but we have definitely stirred up a storm of volatility lately. For those that are patient enough to wait for the right signal, we believe that this market will continue higher, and that 135 handle will be targeted. As far as selling is concerned, we just cannot do it with the Bank of Japan out there waiting to intervene in case of a real meltdown.

As for the Monday 17th daily forecast:

The EUR/JPY pair fell hard during the session on Friday, but as you can see managed to stay above the 125 handle. The 125 handle is major support in this market, and as a result we feel that the market should continue to respect that level. On the other hand, the Bank of Japan is underneath there somewhere as well, and any significant move down from their will more than likely catch the central banks attention, and possibly its intervention. The entire market knows this, and as a result we believe that a bounce is coming again.

By FX Empire Analyst - Christopher Lewis:

As for the Monday 10th daily forecast:

The EUR/JPY pair formed a hammer for the week, and as a result it looks like the market is primed to start going higher again. I frankly, as the Yen had sold off drastically in the middle of the week, a lot of people have stepped in to take advantage of weakness and a market that is without a doubt very strong overall. Going forward, we fully expect this market continue higher, and believe that a breakout is imminent. Nonetheless, expect a lot of volatility above the top of the week’s range, as we would be plowing directly into a shooting star.

As for the Monday 10th daily forecast:

The EUR/JPY pair fell hard during the session on Friday, but as you can see bounced just as hard in order to form a massive hammer. This hammer shows extreme amounts of yen selling, and as a result we think this market will continue higher. Obviously, the 130 level should offer a bit of resistance now, but in the big scheme of things we think the Bank of Japan will continue to work against the value of the yen going forward, and there is also the possibility that the Euro will breakout as well. All things being equal, we are buyers.

By FX Empire Analyst - Christopher Lewis:

As for the Monday 3rd daily forecast:

The EUR/JPY pair initially rallied during the week, but as you can see it fell enough to form a shooting star. However, this shooting star sits on top of the 130 handle, an area of extreme support in this market. Because of this, we don’t feel that this market is necessarily going to fall apart at this point, rather we will find a bit of a grinder going forward.

That isn’t exactly a stretch of imagination anyway, as the market has been so parabolic it really does need to rest from time to time. Looking at the longer-term charts though, we can still make a case for the 150 level based upon a bullish flag that was broken out of earlier this year, we still think that will eventually be what happens.

There will be back from time to time, and we could essentially pullback from here, but we find that there should be far too much support between here and 128 or so to let the market fall much farther than that. Also, it should be noted that the Euro picked up a little bit of strength against the US dollar during the week, and that should bode well for this pair as well.

The Bank of Japan will continue to work against the value of the Yen, and as a result this market will eventually go higher. Perhaps the pullback gives us an opportunity to buy a bit cheaper, but again as I said before, we do not expect much in the way of pullback. We may get as low as 128, but below there it’s a bit difficult to imagine at this point.

A supportive candle will be more than enough reason for us to start buying, and we would use either the daily or weekly charts to enter the market. A break of the high from the previous week is obviously a bullish sign, but quite frankly we are willing to buy any signs of support at all in this market as it has been so bullish for so long.

As for the Monday 3rd daily forecast:

The EUR/JPY pair fell during the Friday session, but as you can see the 130 handle offered support during the day, and we managed to stay above it. The market broke out above the 130 handle a while back, and we and now testing it to see if the former resistance is now support. The ascending triangle suggested that we are going much higher, and we have not done that but we have seen a massive amount of support in this general vicinity. It is because of this that we feel this market will show enough support to start buying now.

By FX Empire Analyst - Christopher Lewis:

As for the Monday 27th daily forecast:

The EUR/JPY pair initially surged higher during the week, but as you can see the 1.3350 level was a bit too much for the buyers. The pullback formed a shooting star that is sitting just on top of the 130 handle, but we believe that there is enough support below that area in order to keep the market somewhat elevated. Any dip below the 130 handle will more than likely find a lot of buyers, so we may have to look to short timeframe charts such as the daily timeframe in order to get our buy signal. Nonetheless, this is a “buy only” market.

As for the Monday 27th daily forecast:

The EUR/JPY pair fell during the day on Friday, but as you can see the 130 handle did in fact hold as support. This level has held as support two days in a row, and it is a significant level. We believe that this market will find a lot of buyers at that level unless something catastrophic happens, and as a result this may be a decent area to go ahead and try to start buying. Don’t expect an easy move higher, but in the long run this pair is definitely going higher.

By FX Empire Analyst - Christopher Lewis:

The EUR/JPY pair had a strong showing on Friday, as the Yen sold off against most other currencies. This pair has been massively bullish over the long run, and we have recently just broken out of an ascending triangle that should see this pair go much higher. Quite frankly, based upon this triangle, we should see a move to the 137 handle.

Looking at this chart, it’s hard not to mention that there is a hammer on the weekly chart as well, so move higher is indeed strong based upon short and long term charts. This of course jive well with the overall trend, and let’s not forget that the Bank of Japan is aggressively selling off the Yen in its own way by purchasing bonds from the government.

Going forward, we think that the Yen will continue to depreciate, and this will be exacerbated by the fact that the G 20 couldn’t be bothered to suggest that the Japanese were doing anything wrong. In other words, there will be other central banks fighting this move.

Going forward, we think that the Yen will continue to depreciate, and this will be exacerbated by the fact that the G 20 couldn’t be bothered to suggest that the Japanese were doing anything wrong. In other words, there will be other central banks fighting this move.

If that’s the case, this trade is still fairly young in its duration, and we do believe that it will be a long-term trade. We look at this chart and think in terms of months, if not years, and not days or hours. There are plenty of investors out there simply buying this pair and leaving it be. We believe that you could have a “core position” in this market, and add and subtract if you go along. Of course, you have to be aware of your countries FIFO laws, and whether or not this would have an effect on scaling in and out of a position dynamically.

Nonetheless, it’s abundantly clear that you cannot short this pair under any circumstances. Although there have been times when this market has pullback suddenly, but every time this is happened it’s been a buying opportunity. There is nothing on this chart that suggests that’s about to change anytime soon as the bullishness looks like it’s just starting up.

The EUR/JPY pair fell during much of the week, but as you can see gained towards the end in order to form a hammer. It now looks as if the 131 level is going offer support, and that the market can continue higher. Quite frankly, if it weren’t for the fact that the Euro had performed so weakly, this pair would’ve gone much higher. However, the Euro struggle most of the five sessions. Nonetheless, this is an anti-Yen play, not necessarily a pro-Euro one. That being said, a break above the highs from this past week leads us to the 135 handle.