By FX Empire Analyst - Christopher Lewis:

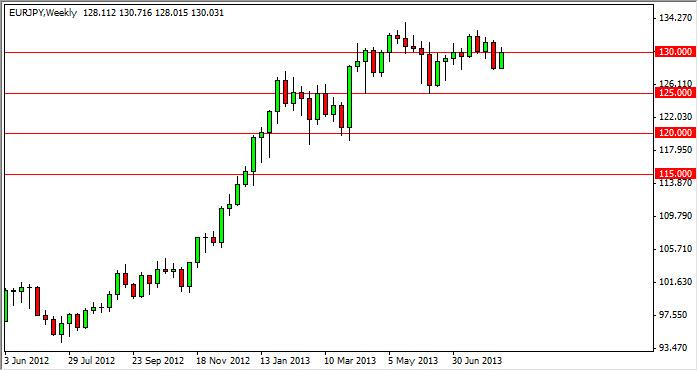

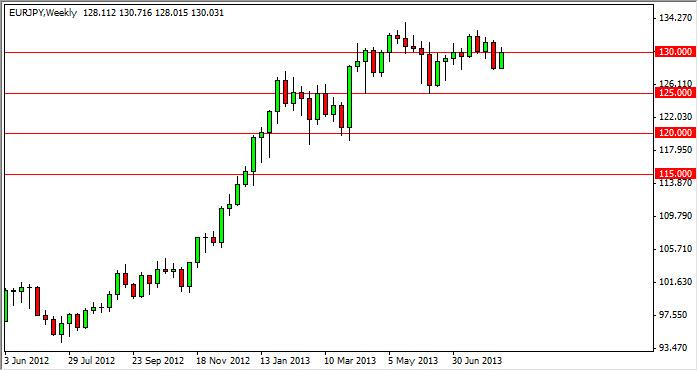

The EUR/JPY pair tried to rally during the week, but as you can see gave back most of the gains. With that being said, this market formed a shooting star that sits right on top of the 130 level, an area that has been supportive. Because of this, we feel that the market may try to pullback, but there is so much support below that selling this market is dangerous to say the least. In fact, if we fall at this point in time, we are willing to buy supportive candles as they appear.

As for the Monday 9th daily forecast:

The EUR/JPY pair fell hard during the session on Friday, but slammed into the large support level yet again in order to find the whole. The 130 level has been massive and its implications, and as a result buyers stepped in and push the market back up. On short term charts, we are more than willing to buy this market as we think it will continue to consolidate between 130 and the 132.50 levels over the next several sessions. However, we are more bullish than bearish, and would be more comfortable buying then selling at this point.

By FX Empire Analyst - Christopher Lewis:

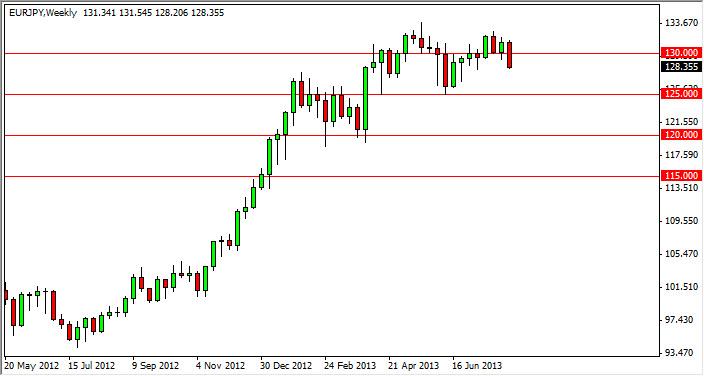

The EUR/JPY pair rose during the week, slamming into the 130 handle again. We still believe that this pair is in an uptrend, and it is simply taking a bit of a break for the summer. That being the case, we are more than willing to buy on a break above the 130 level based upon a daily close. However, real traction in this pair will be picked up until we get above the 133 handle, something that doesn’t look likely in the next couple of weeks considering the fact that we are in the dead of summer.

The EUR/JPY pair rose during the week, slamming into the 130 handle again. We still believe that this pair is in an uptrend, and it is simply taking a bit of a break for the summer. That being the case, we are more than willing to buy on a break above the 130 level based upon a daily close. However, real traction in this pair will be picked up until we get above the 133 handle, something that doesn’t look likely in the next couple of weeks considering the fact that we are in the dead of summer.

As for the Monday 19th daily forecast:

The EUR/JPY rose during the session on Friday, but struggled at the 130 handle as you can see. This is a level that has been hotly contested recently, and as a result it does not surprise us to see the market gravitate towards it, but not really be able to break free of it. On a move above 131 though, we think this market will head the 133. On pullbacks we find this market interesting, and would buy supportive candles all the way down to the 128 handle in the immediate future. Below there, we feel that the 125 level is the floor in the market as well.

By FX Empire Analyst - Christopher Lewis:

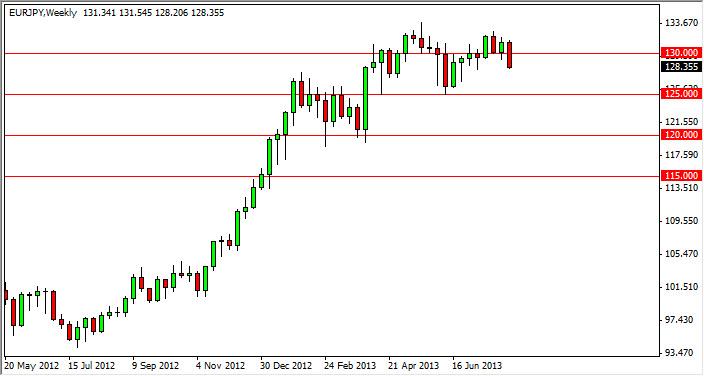

As for the Monday 12th daily forecast:

The EUR/JPY pair fell during the session on Friday, attempting the bottom of the hammer from the Thursday session. We are still above the 128 handle though, and there is a significant amount of support in this general vicinity. Beyond that, there is a ton of support down at 125, so we think that any downside move will be somewhat limited. Are looking for a supportive candle in order to start buying, but we simply do not have it at this point in time. We actually get more interested in going long the lower that we go in this pair.

The EUR/JPY pair fell during the balance of the week as we crashed through the 130 level, an area that had been rather supportive. However, we see quite a bit of support all the way down to the 125 handle, so we’re not very impressed. In fact, we feel that we are simply going to flounder around between 125 and 133 for the remainder of the summer. Right now, and looks like this market is heading lower, but we feel much more comfortable going long as his pair has been so bullish lately.

As for the Monday 12th daily forecast:

The EUR/JPY pair fell during the session on Friday, attempting the bottom of the hammer from the Thursday session. We are still above the 128 handle though, and there is a significant amount of support in this general vicinity. Beyond that, there is a ton of support down at 125, so we think that any downside move will be somewhat limited. Are looking for a supportive candle in order to start buying, but we simply do not have it at this point in time. We actually get more interested in going long the lower that we go in this pair.